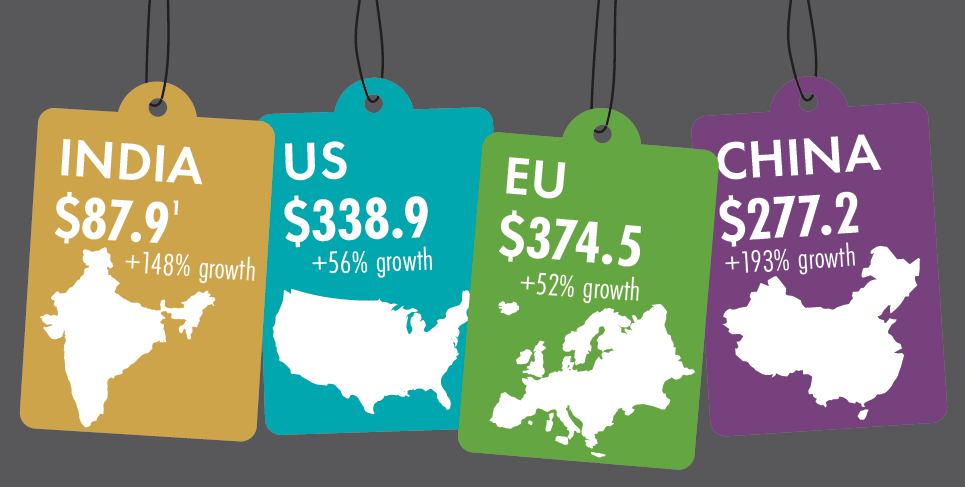

APPAREL SPENDING

Indian consumers spent $87.9 billion on clothing in 2017, representing 6% of all consumer expenditures. Spending on clothing is expected to keep pace with projected growth in the economy overall, for a total 148% increase in clothing expenditures by 2030. Seize opportunities in this market with online investment and cotton-rich traditional clothing and menswear.

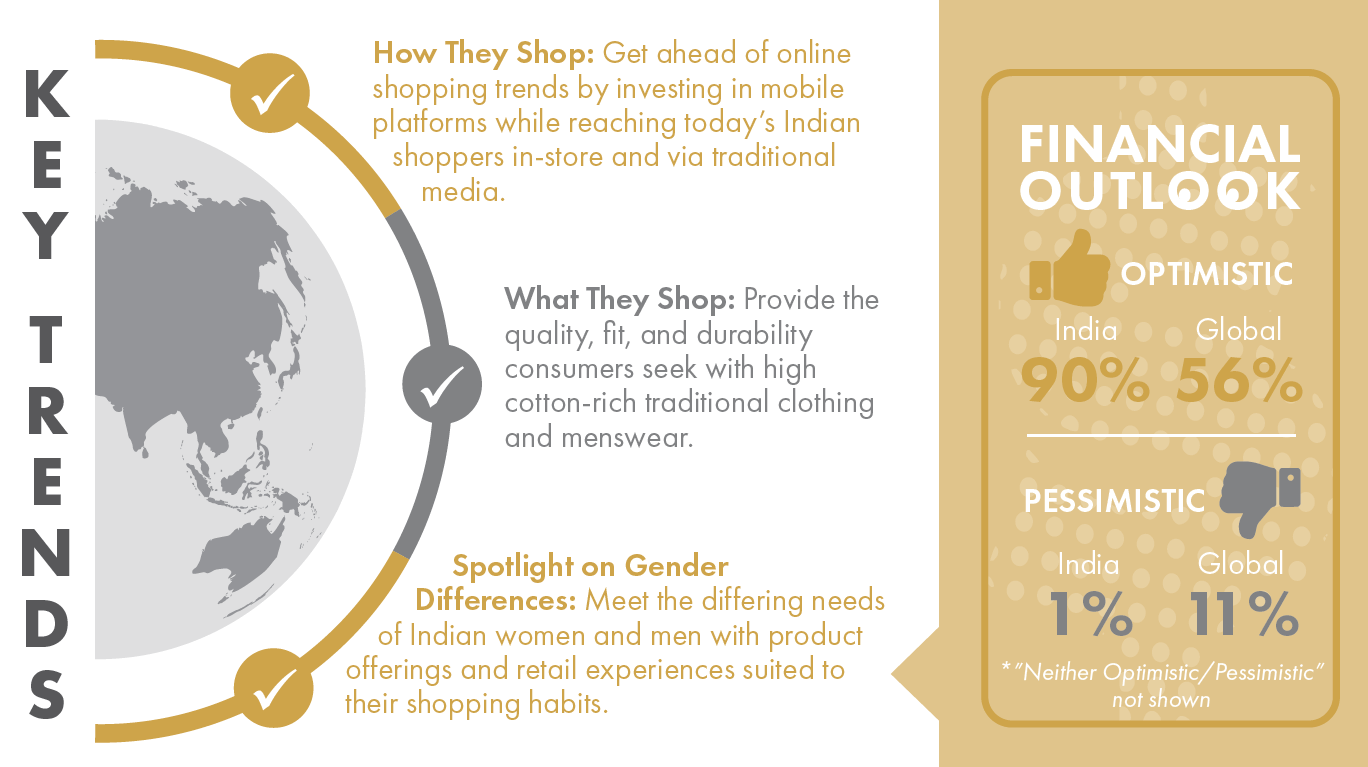

HOW THEY SHOP

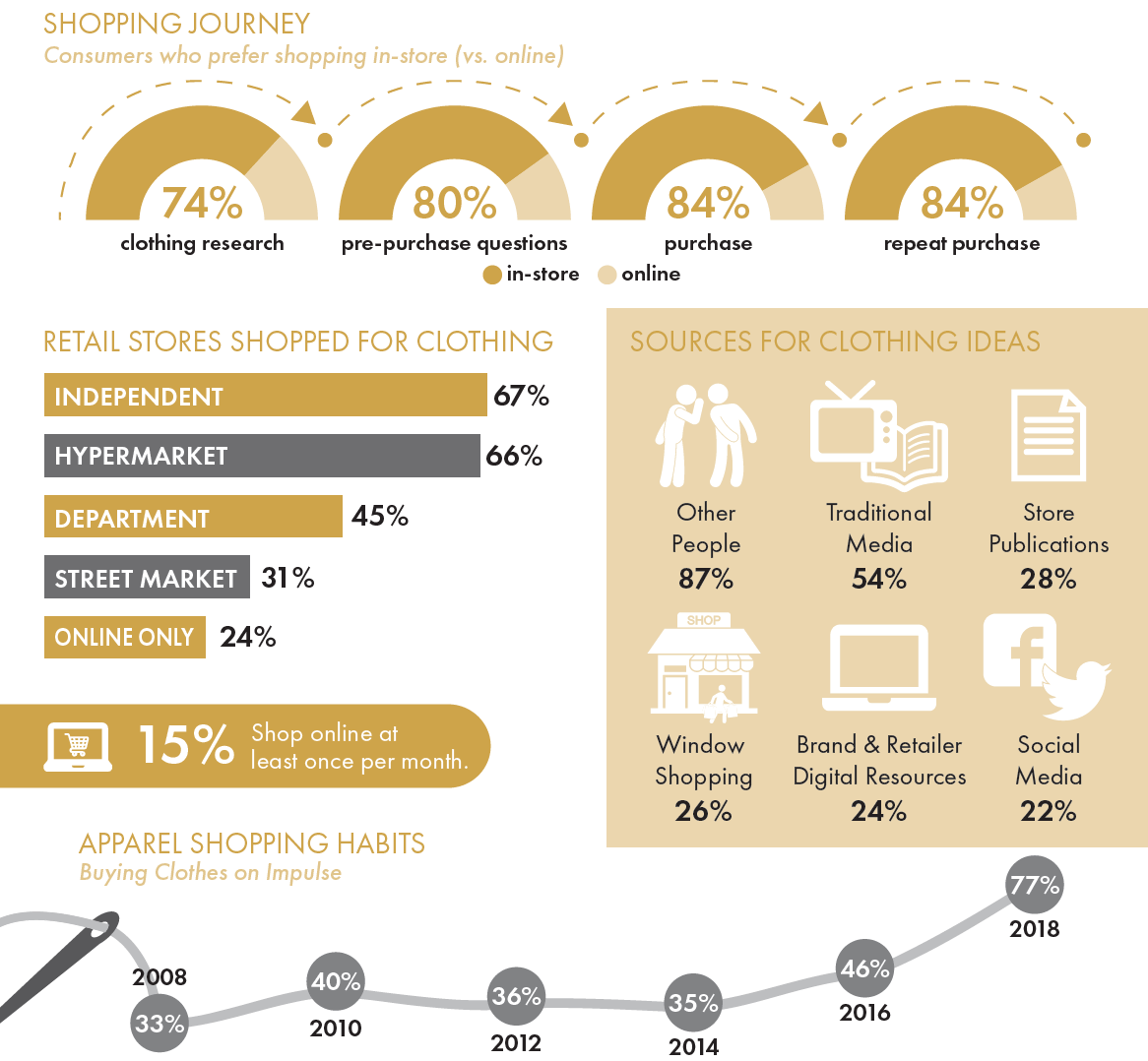

Indian consumers are interested in shopping online, but with just 27% of the population using the internet regularly (weekly or more)¹, lack of internet access prevents widespread online shopping. However, it’s projected that 90% of the population will own a smartphone in the next 10 years¹, indicating a strong future demand in mobile shopping. Small, independent shops and traditional street markets are frequent shopping destinations, along with hypermarkets and department stores. Reach Indian shoppers in-store and via traditional media while growing mobile platforms to meet future online shopping demands.

WHAT THEY SHOP

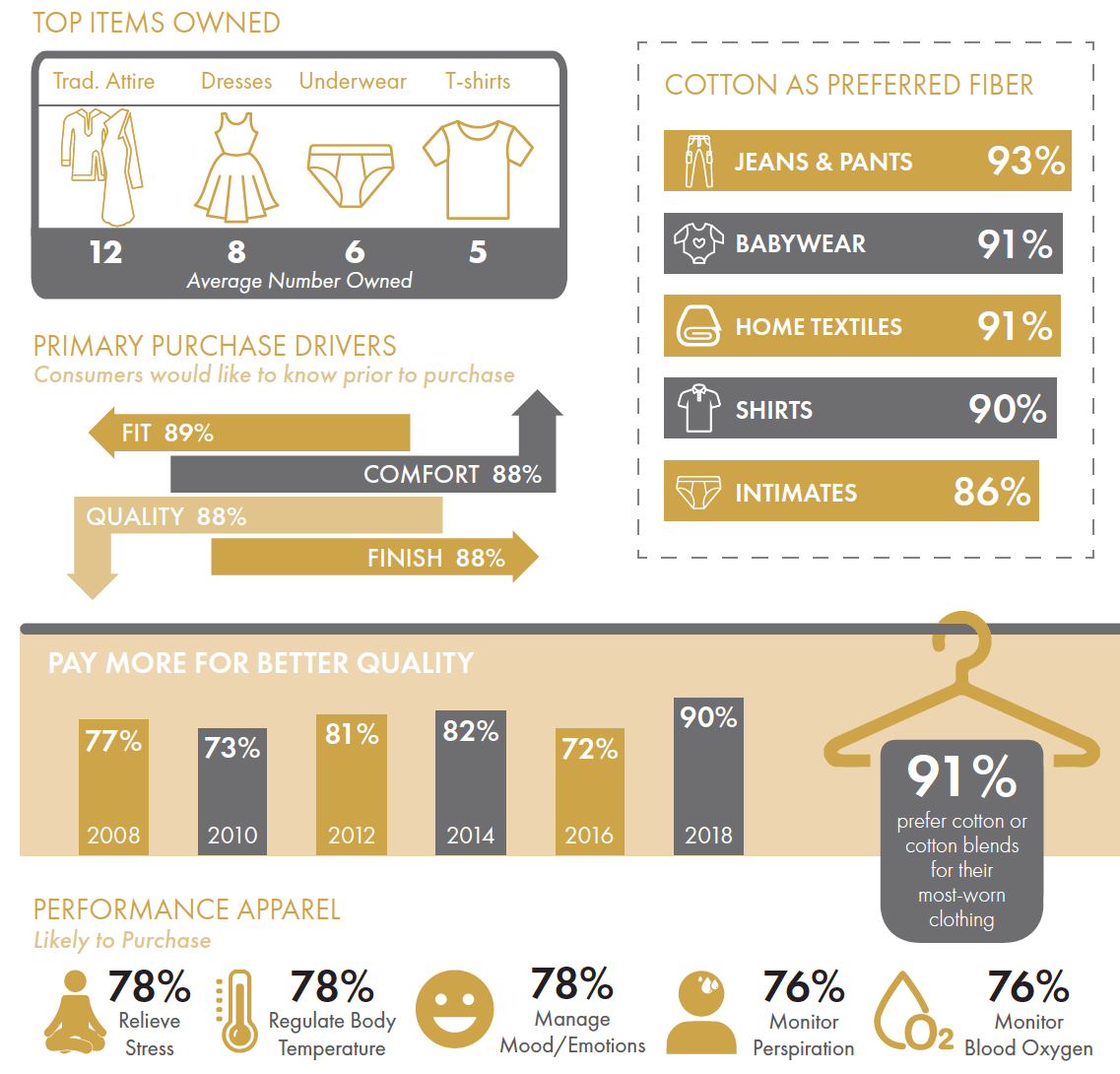

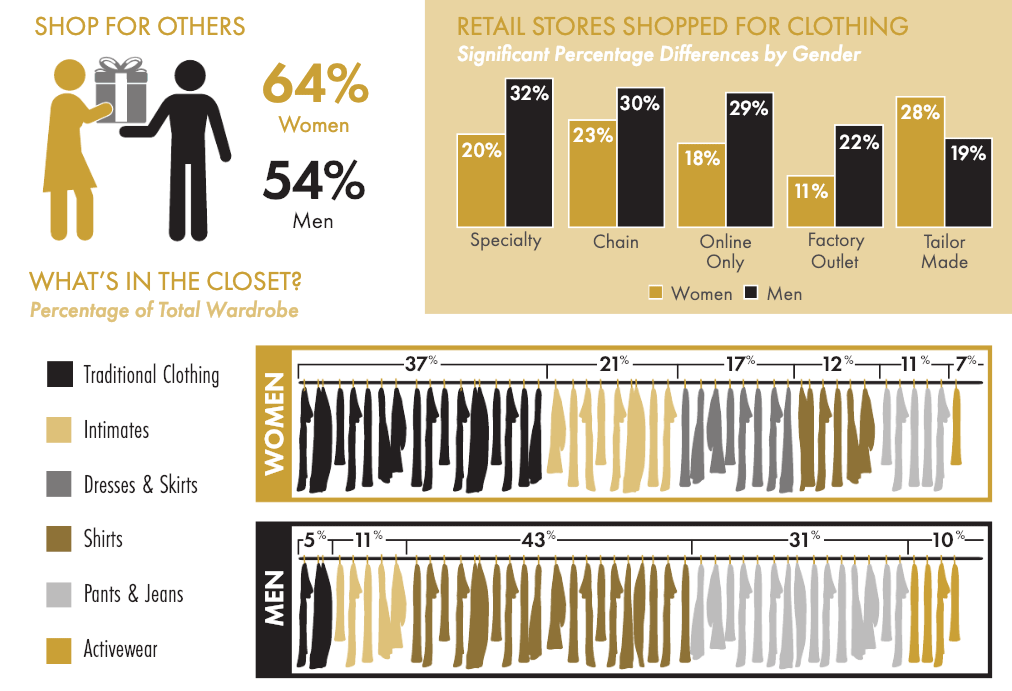

Fit, durability, quality, and finish are important clothing factors to Indian consumers, and nine in ten choose cotton-rich fabrics for garments of all types. Dresses and traditional clothing such as saris comprise nearly half (43%) of women’s wardrobes, while men own both dress and casual pants and shirts. Indian consumers value quality in clothing, as nine in ten are willing to pay more for quality. Offer high quality, cotton-rich traditional clothing and menswear with a superior fit.

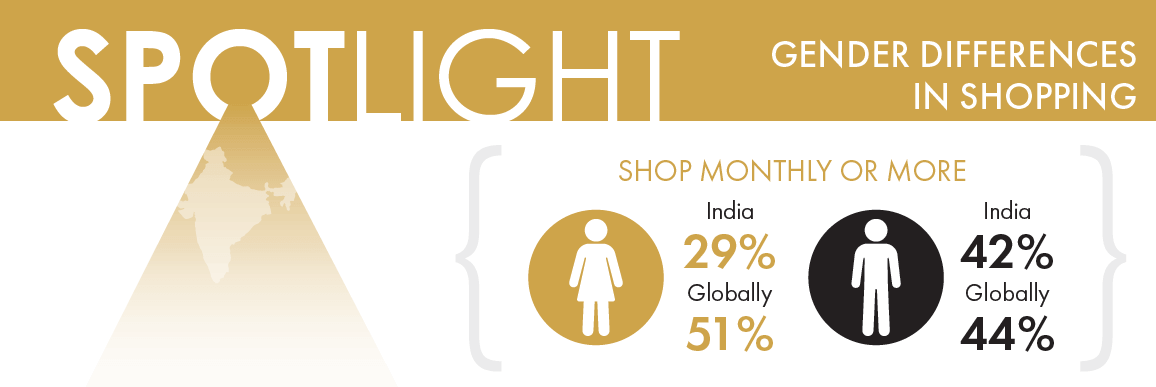

Men and women shop for clothing quite differently in India. While nearly all (95%) Indian women enjoy clothes shopping, they break from the global trend as they report shopping for clothes less often than their male counterparts. As just 27% of Indian women work outside the home² – among the lowest worldwide – men are more likely to buy Western clothing in specialty and chain stores, while women frequent tailor-made shops for traditional clothing. Adapt retail experiences to women and men with offerings suited to their differing clothing and shopping preferences.

Source: Cotton Council International and Cotton Incorporated’s Global Lifestyle Monitor Survey, a biennial consumer research study. In the 2018 survey approximately 10,000 consumers (i.e. 1,000 consumers in 10 countries) were surveyed.External Source: ¹Euromonitor International, ²WorldBank.